In recent years, Latvia has demonstrated tangible progress in strengthening its insolvency framework, driven by a strategic focus on procedural efficiency, transparency, and creditor rights protection. Key efficiency indicators in 2024 reflect structural improvements, including reduced resolution time, lower insolvency-related costs, and higher recovery rates for creditors.

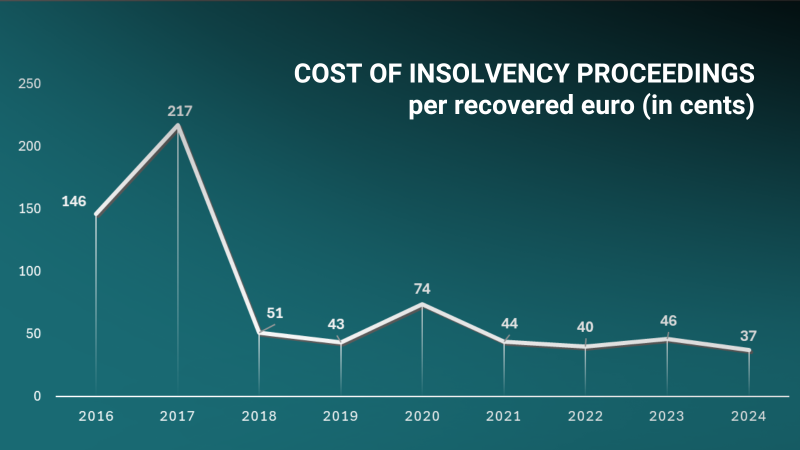

Sharp decline in insolvency process costs – 75% reduction since 2016

The cost of resolving insolvency has significantly reduced—from € 1.46 per euro recovered in 2016 to just € 0.37 in 2024. This marks a 75% decrease, largely driven by lower administrative expenses and improved procedural streamlining. These results were driven in large part by the Insolvency Control Service, particularly through enhanced supervisory measures and the implementation of digital tools for insolvency case management.

Shorter time to resolution – currently 1.8 years

As of 2024, the average time to resolve insolvency cases in Latvia has decreased to 1.8 years—the shortest duration recorded in the past four years. Faster case resolution contributes to more timely reallocation of resources, reduced uncertainty, and improved outcomes for creditors and debtors alike. These gains are attributed to digital case processing systems, risk-based supervision, and enhanced cooperation among insolvency practitioners and institutional stakeholders.

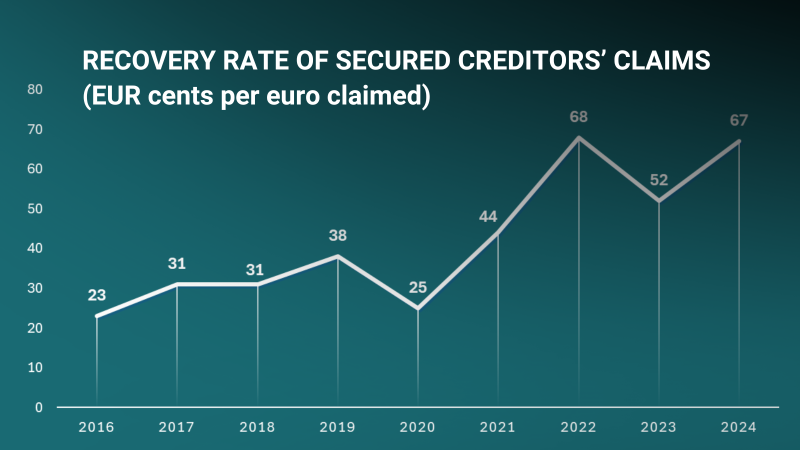

Recovery rates improve – secured creditors recover 67 cents per euro

Creditor recovery rates continue to improve – in 2024, secured creditors recover on average 67 cents per euro, indicating positive trends in the efficiency of the insolvency process.

Enhanced administrator performance and supervision

Since 2016, Latvia has introduced significant reforms in the insolvency field – supervision mechanisms have been enhanced, ethical standards and mandatory qualification exams implemented, and professional development measures taken for administrator's profession. These changes have also affected the number of licensed administrators, which has more than halved – from 312 to 133. However, this has not negatively impacted process quality or outcomes. Increased competition within the profession has encouraged greater professional responsibility and improved work quality, overall boosting the efficiency of the insolvency process.

Digitalization as a driving force for development

The digitalization of the insolvency process has played a key role at every stage – from document circulation to the supervision of administrators. Latvia’s electronic insolvency accounting system ensures centralized, transparent, and efficient insolvency case management on a 24/7 basis. It enables simultaneous data access for the Insolvency Control Service, administrators, courts, and creditors, accelerating information exchange, decision-making, and reducing the administrative burden on all parties involved in the insolvency process.