The insolvency administrator (hereinafter - administrator) plays a central role in ensuring a lawful and efficient insolvency proceeding. For a long time the insolvency sector in Latvia was accompanied by scandals, criticisms and substantiated suspicion of abuse of power and involvement in criminal offences by administrators. The arbitrariness of administrators was often exposed in the media and also non-governmental organisations representing entrepreneurs expressed their concerns about the insolvency sector. In 2016, the Foreign Investors Council in Latvia published the Insolvency Abuse Report, where it was concluded that Latvia suffered losses of €600 million as a result of abusive actions.

Administrators' Office Requirements

In order to change the situation in the sector, the government in 2016 approved the 2016-2020 Guidelines for the Development of Insolvency Policy, where one of the action lines is to ensure that administrators are skilled professionals who effectively fulfil their duties and care about the prestige of the profession. To ensure that administrators are professional, acting in good faith and with a good repute, the state in 2017 made amendments in the Insolvency Law– this is the so-called administrators' professional reform. This entitles regular reassessment of administrator's qualification thought regular examination, disciplinary responsibility and a requirement for a good reputation. In addition the supervision of administrators was significantly strengthened: independent examination and disciplinary committees were set up, matters relating to the office of administrators were referred to the Insolvency Control Service, and also the authority was granted the right to carry out on-site inspections; the introduction of the Electronic Insolvency Accounting System which also increased off-site supervision possibilities.

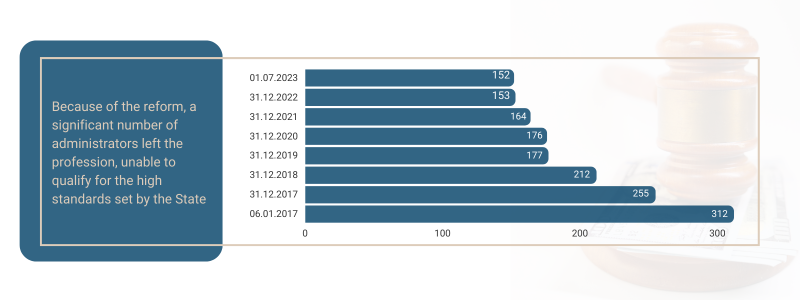

Significant Number of Administrators Have Left The Office

As a result of the before mentioned reform, a significant number of administrators left the profession, unable to qualify for the high standards set by the State. Many failed or refused to carry out the qualification examination, and a number of administrators left the profession or were suspended as a result of criminal proceedings. There was also a relatively large number of administrators who were dismissed from the profession for breaches of legislation or abuse of power, some administrators lost their positions for the lack of good repute, and there was a clear trend for administrators to request termination of their appointment at a time when the Insolvency Control Service started on-site inspections. As a result, the number of administrators has more than halved since the beginning of 2017, i.e., 312 administrators were practising at the beginning of 2017 and 152 administrators on 1st July 2023.

Does The Number of Administrators Affect the Effectiveness of Insolvency Proceedings?

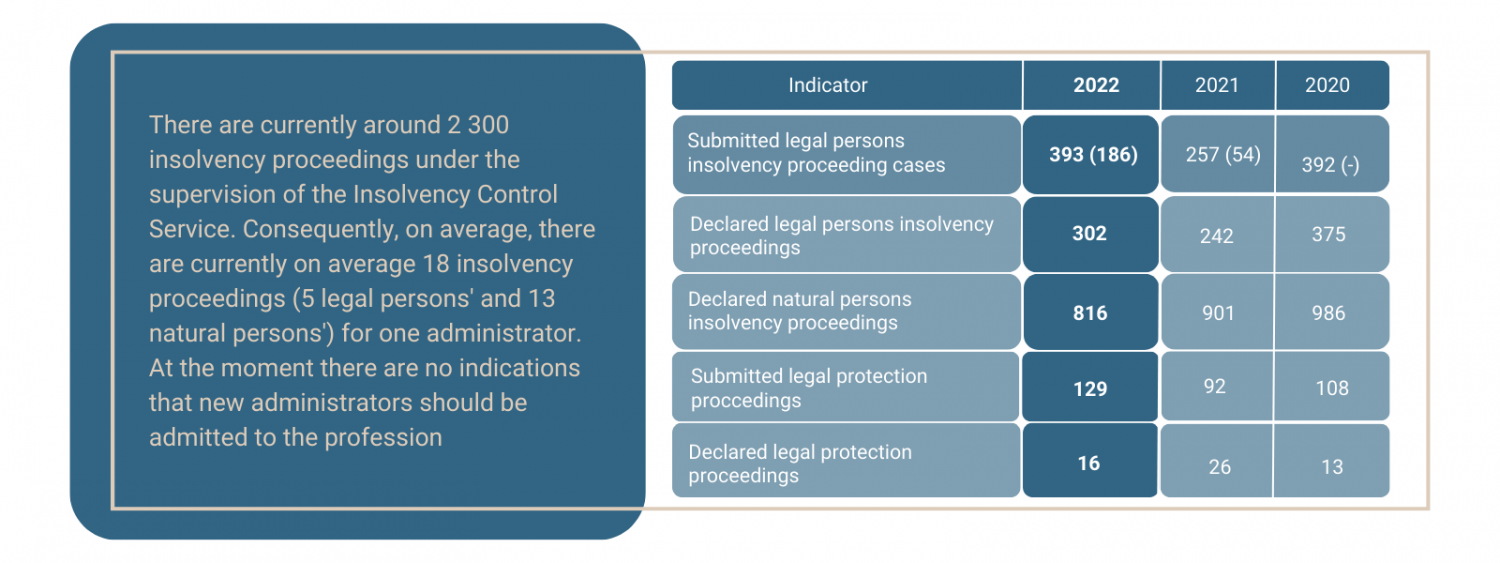

It is justified to ask what is the optimal number of administrators in the profession and whether such a significant drop in the number of administrators does not indicate that existing administrators are unable to administer insolvency proceedings qualitatively and effectively? Inese Šteina, director of the Insolvency Control Service, explains: "The issue of the optimal number of administrators in the profession depends on a variety of factors: the current number of insolvency proceedings, the size and complexity of the insolvent companies and other factors closely related to economic processes in the country. Overall, there are currently around 2 300 insolvency proceedings under the supervision of the Insolvency Control Service. Consequently, on average, there are currently on average 18 insolvency proceedings (5 legal persons' and 13 natural persons') for one administrator. Such an indicator does not objectively raise concerns about work overload and is even considered insufficient among administrators. At the moment there are no indications that new administrators should be admitted to the profession. The Insolvency Control Service shall continuously follow the dynamics of the number of insolvency proceedings and shall immediately report to the Insolvency Advisory Council on the need to recruit new administrators. Moreover, the supervisory results analysed in the Insolvency Control Service' 2022 Report clearly show that the quality of the work of administrators and the number of administrators are crucial to the effectiveness of insolvency proceedings'.

Number of Infringements Decrease

The supervision data show that currently mostly professional and motivated administrators are in the profession. Inese Šteina reveals: “There are less and less cases where administrators have knowingly committed significant regulatory violations. Since 2017, the number of complaints has fallen by 65% and the number of irregularities recognised has fallen by 74%. Also, I would like to highlight risk-based preventive measures as an essential supervisory instrument. In the initial years of implementation of the reform, the number of irregularities detected increased due to a significant increase in supervisory measures implemented by the Insolvency Control Service. For example, in the Supervisory Strategy 2022-2023 the Insolvency Control Service set out a task of verifying whether administrators had evaluated debtor's transactions which were conducted before the insolvency proceedings. Although some irregularities are identified in this area, their number has decreased significantly, with administrators having a greater understanding of the importance of comprehensive transaction assessment and the implementation of liability measures. In the event of a reduction in cases where serious infringements are committed in insolvency proceedings, the Insolvency Control Service is increasingly applying the “Consult First” principle. The measures taken have also resulted in improvements in the overall insolvency proceedings' indicators - increased recovery rates and reduced costs of insolvency proceedings. Indeed, the abnormally high costs of insolvency proceedings have historically been marked as one of the biggest problems in the insolvency sector, and their control has long been a priority for the institution. In 2022, that figure reached 0.40 euro cents per cent as part of a recovered euro insolvency process, which is the lowest figure in recent years.

Focus on Viable Businesses

Inese Šteina: "The reform of the profession of administrators has produced its desired result - there are virtually no administrators who use insolvency proceedings contrary to their purpose. With the reform now concluded, the sector needs to focus on other key issues: more successful legal protection proceedings in Latvia and fewer companies that end up in insolvency proceedings "empty"".